How TechSurgeAI Is Powering AI Transformation in Financial Firms

AI in Finance: A Market on the Rise

Artificial intelligence is no longer a futuristic concept in finance, it’s now the engine driving measurable growth. In 2024, the global AI-in-finance market reached $38.36 billion, and it’s expected to hit $190.33 billion by 2030. However, many financial firms still struggle to turn AI investments into clear business outcomes.

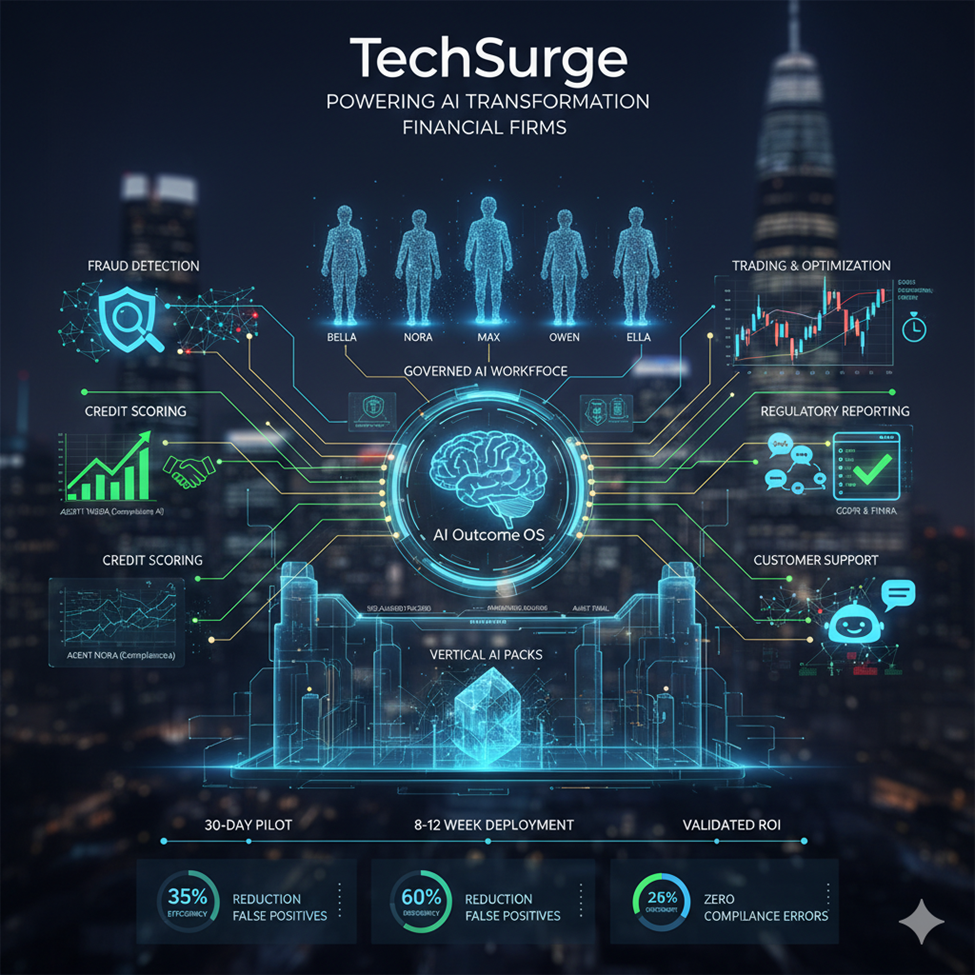

TechSurge addresses this challenge with its AI Outcome OS, a unified platform that combines governed AI agents, industry intelligence packs, and automated workflows. This system delivers results faster, more securely, and with verified ROI. By allowing financial institutions to launch pilots within 30 days and validate outcomes before scaling, TechSurge turns AI from a promise into a proven growth driver.

Building the Foundation for Trusted AI

Modern financial organizations face two major challenges: rising data volumes and strict regulations. Traditional analytics systems were never designed for such complexity. TechSurge’s AI Engineering and MLOps framework bridges this gap, converting AI concepts into production-ready systems in just 8 to 12 weeks. The process includes drift detection, automated retraining, and ongoing monitoring.

At the core lies TechSurge’s Governed AI Workforce human-branded AI agents like Bella (Compliance) and Nora (Support). These agents combine domain expertise with full regulatory alignment. Together with Vertical AI Packs such as SurgeFinance, they help finance teams act faster, comply better, and innovate with confidence.

Reinventing Fraud Detection and AML

Fraud and money laundering cost the global finance industry billions each year. Traditional rule-based systems often trigger too many false alerts, wasting analyst time. TechSurge’s SurgeFinance AML model, powered by Agent Nora, uses graph-based anomaly detection and real-time scoring to pinpoint suspicious behavior more accurately.

As a result, false positives drop by up to 60%, and investigation time shrinks from 24 hours to under 4. Every model decision is logged and mapped to regulations such as GDPR and FINRA, ensuring compliance at every step.

Credit Scoring That’s Faster and Fairer

Loan approvals and credit assessments are vital to financial operations, yet they often slow down decision-making. With TechSurge’s AI Outcome OS, underwriting becomes data-driven rather than intuition-based. Eli, the Underwriting AI, evaluates both traditional and alternative data sources, including transaction behavior and spending patterns.

Consequently, loan decisions that once took two days now finish in under 15 minutes. Non-performing loan rates also drop by up to 20%. Built-in dashboards ensure each decision remains transparent, explainable, and ready for regulatory review.

AI-Driven Trading and Portfolio Optimization

In trading, milliseconds matter. TechSurge’s Agentic Systems combine data collection, model training, and trade execution into one governed process. Reinforcement learning models help optimize execution costs, while the Ops AI Team monitors model performance in real time.

This results in up to 20% improvement in execution efficiency and a complete audit trail for every trade, balancing speed with full compliance.

Smarter, Always-On Customer Support

Today’s financial clients expect instant, personalized, and round-the-clock assistance. TechSurge’s Support AI Team including agents Max, Owen, and Ella, deliver exactly that. Integrated across chat, email, and voice, they handle common inquiries and escalate complex issues with full context.

Within 60 days, institutions using this system have achieved 30% ticket deflection, faster response times, and higher satisfaction scores. Governance ensures every conversation follows privacy laws and company policies.

Redefining Regulatory Reporting

Compliance remains one of the most resource-heavy functions in finance. TechSurge’s Compliance AI Team, featuring Nora and Ethan, automates policy mapping, data protection assessments, and control scoring. Reports that once took days are now ready in minutes with 100% mapped logs and zero non-conformities.

Moreover, every AI decision is documented and traceable, enabling firms to meet changing regulations confidently.

Automating the Financial Back Office

Beyond customer-facing tasks, TechSurge also automates core operations such as invoice reconciliation and trade settlement. The Ops AI Team led by Zane, Ella, and Rex applies intelligent automation and digital playbooks to remove manual effort.

As a result, clients see a 40% reduction in mean time to resolution (MTTR) and fewer escalations. This goes beyond cost savings it builds operational resilience powered by continuous learning.

Risk Management That Learns and Adapts

Financial risk management demands both precision and speed. TechSurge’s Risk AI Pack combines Monte Carlo simulations with machine learning models to predict outcomes under various market stresses.

These insights flow into SurgeControl, where Bella (Compliance) verifies governance alignment. Consequently, risk frameworks evolve continuously, strengthening the institution’s ability to anticipate and mitigate threats.

Governed Architecture for Enterprise AI

At the center of this ecosystem lies TechSurge’s AI Outcome OS — a secure, compliant architecture managing the entire AI lifecycle. From data ingestion to deployment, each component (feature store, model registry, and audit trail) follows ISO-aligned governance. Real-time drift detection and explainability features ensure transparency for both regulators and auditors.

The Measurable Impact

TechSurge’s approach is rooted in measurable results, not experiments. Financial organizations using its platform have reported:

-

30–35% improvement in operational efficiency

-

60% fewer false positives in fraud detection

-

Zero compliance errors in audits

-

Verified ROI within the first 60 days

These outcomes prove that when governed correctly, AI does not just automate, it amplifies business performance.

The Path to Enterprise-Grade AI

TechSurge’s roadmap follows a simple but powerful model:

-

Identify a high-impact use case.

-

Launch a 30-day pilot.

-

Validate ROI through SurgeControl dashboards.

-

Scale across departments with continuous optimization.

This Outcome-as-a-Service approach ensures every project starts small, scales quickly, and stays secure throughout the process.

Why Financial Leaders Choose TechSurgeAI

For executives navigating the AI revolution, TechSurgeAI provides a clear path forward start with governed pilots, measure ROI in real time, and scale with confidence. Leadership teams appreciate how the platform blends speed with security, ensuring every AI initiative remains explainable and profitable.

Each deployment is designed to make AI work like a trusted colleague reliable, auditable, and focused on outcomes.

Conclusion: From Cautious to Confident AI Adoption

The future of finance isn’t defined by automation alone it’s defined by trusted automation. TechSurge delivers this through domain expertise, secure architecture, and measurable results. By embedding governance into every stage, TechSurge helps banks, insurers, and fintechs evolve from cautious experimentation to confident execution.

With TechSurge’s AI Outcome OS, financial firms don’t just use AI they govern it, scale it, and profit from it safely.